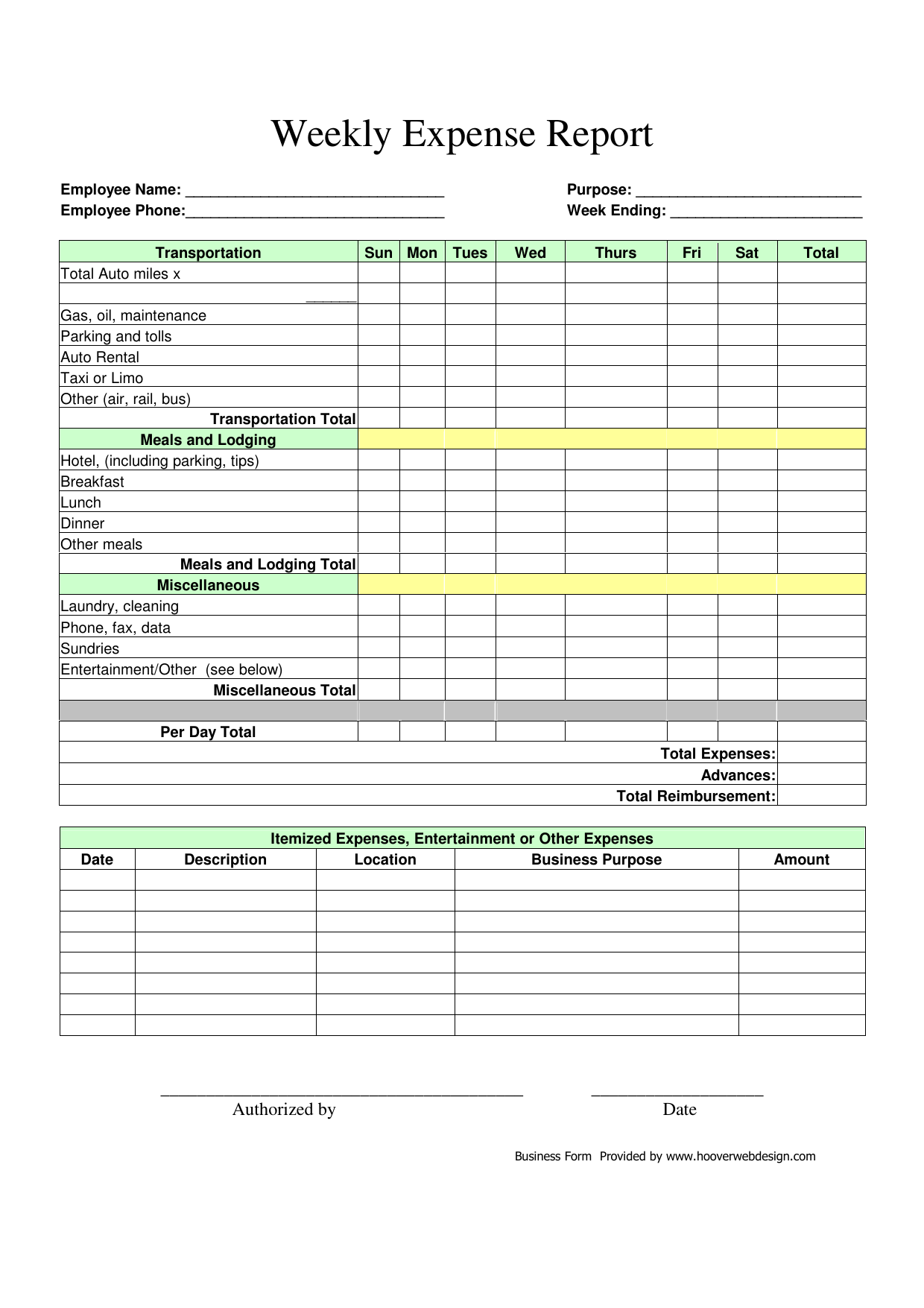

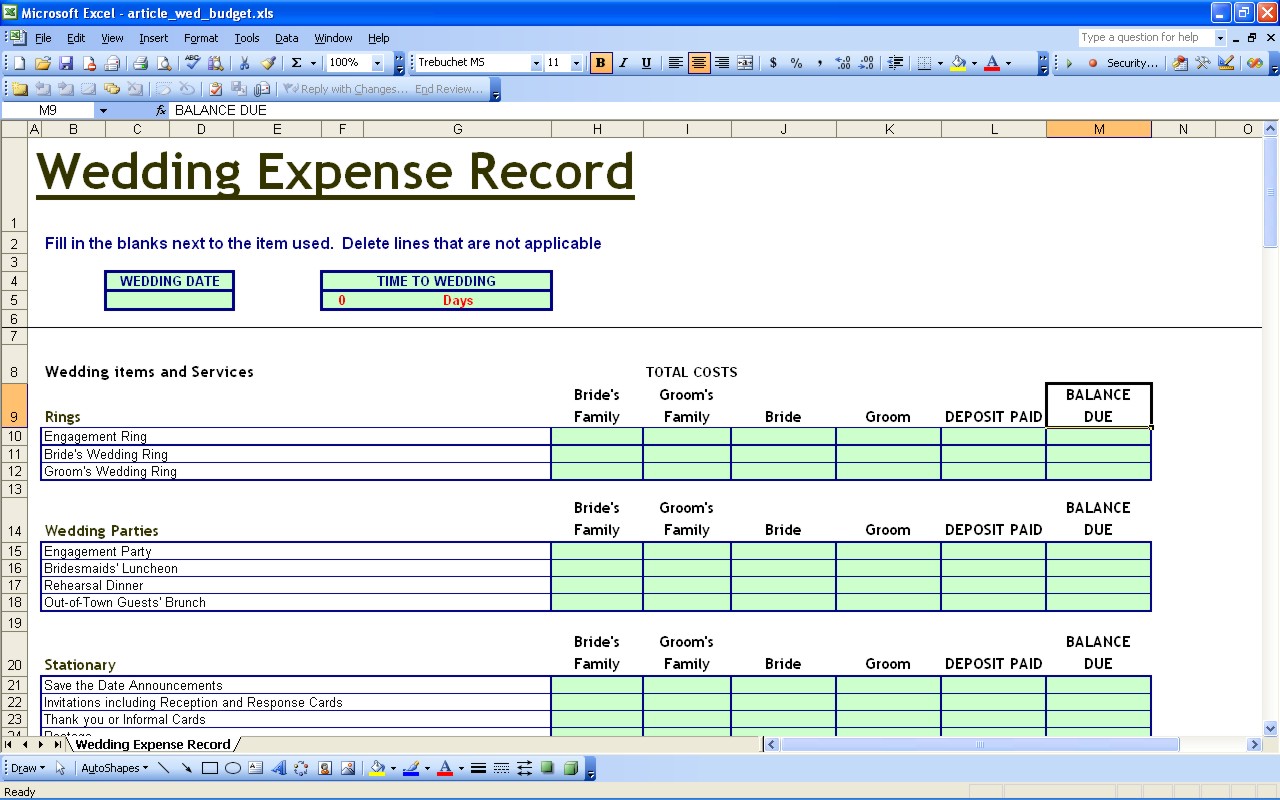

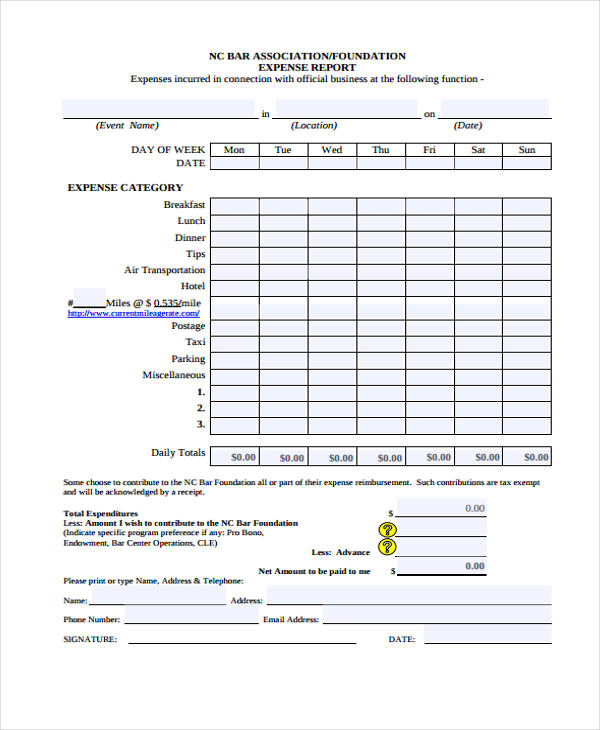

Regularly monitor your expenses to see if they’re in line with your budget.ġ0. Develop a monthly, quarterly and annual budget based on past expenditures. Using your accounting software, create weekly and monthly reports to examine your expenses and revenues. Making an expense report from scratch can be time consuming. Look for products that integrate easily with your existing accounting software.ĩ. Choose a Template (or Software) To make an expense report, you should use either a template or expense-tracking software. There are mobile apps (applications) and cloud-based solutions that enable you to track expenses wherever you are and categorize them to the appropriate project or client. And with most retailers now accepting credit cards for amounts as small as $5, there’s little need to carry cash.Ĩ. Using business credit cards streamlines expense recording, since business credit card statements typically break down your monthly, quarterly and annual spending into categories. Regularly documenting data saves you time in the long run and ensures your financial records are always up to date.ħ. Record expenses as soon as possible after they occur so you don’t end up with piles of receipts. Save storage space and hassles by using a scanner or your smartphone to create PDFs or photos of receipts and file them digitally.Ħ. Jot down the purpose of the expense on each receipt. You’ll need receipts to document tax-deductible expenses in case you’re ever audited. Create a cash account in your financial software to track cash expenditures.ĥ. Limit the use of petty cash to times when it’s absolutely necessary. Petty cash expenditures can create problems if not adequately tracked.

Even if you reimburse yourself or employees for these expenditures, commingling funds adds unnecessary complexity and can expose your business to IRS scrutiny.Ĥ. Avoid using personal cash, checking accounts or credit cards for business expenses. Never Mingle Business and Personal Funds.

Visit the IRS website for details on deductible business expenses.ģ. Be especially sure to accurately record expenses you plan to deduct on your business taxes, such as travel and entertainment, business use of vehicles, office equipment and supplies, association fees and charitable contributions. Be sure to choose the same program your accountant uses or one that is compatible this makes it easy for you or your accountant to import information directly to your tax return at tax time. Microsoft Office also offers spreadsheet templates you can use to track business expenses.Ģ.

#Buisness expenses receipt spreadsheet software#

Accounting software such as QuickBooks greatly simplifies tracking and managing expenses. To improve the way you track and manage your business expenses, try these 10 tips.ġ. Are you properly tracking and managing your small business’s expenses (the costs associated with operating your business)? Recording and regularly reviewing your business expenses helps you pinpoint unnecessary expenditures, cut costs and be better prepared come tax time.

0 kommentar(er)

0 kommentar(er)